Texas has the most uninsured population: Don't be a statistic

Texans are the highest uninsured population in the nation. We can help you find affordable coverage that meets your needs. Don't be a statistic, be protected!

Texans are the highest uninsured population in the nation. We can help you find affordable coverage that meets your needs. Don't be a statistic, be protected!

live until they are 85.2 years old.

live until they are 85.2 years old.If you were born between 1946-1964 you are a baby boomer.

You are probably living pretty well, but in the back of your mind, you know you have not saved enough for your retirement…a...

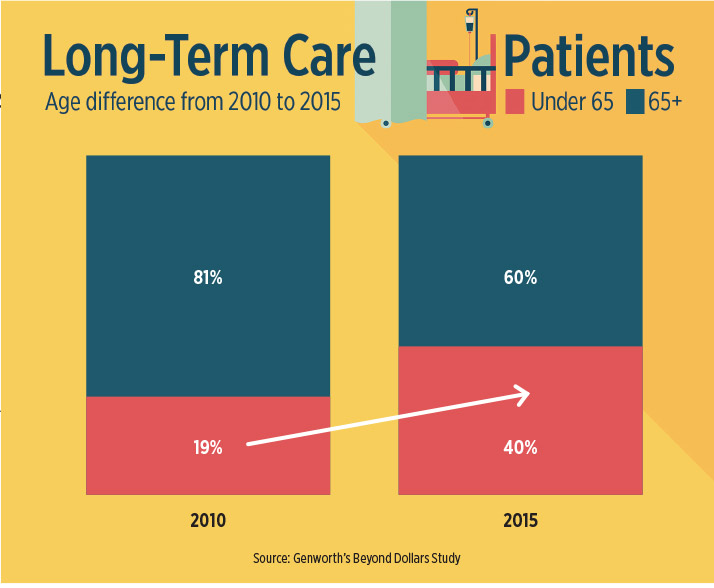

Most small business employees and owner benefit packages have a glaring coverage gap that is becoming increasingly harder to ignore as baby boomers become older and younger employees become caregivers. I’m referring to insurance that covers long-term care. This is coverage that h...

Most small business employees and owner benefit packages have a glaring coverage gap that is becoming increasingly harder to ignore as baby boomers become older and younger employees become caregivers. I’m referring to insurance that covers long-term care. This is coverage that h...

In February, Houston lawyer John Mastriani went to see an ophthalmologist after noticing a problem with his vision. The physician told Mastriani he'd suffered a detached retina and needed surgery as soon as possible.

Dr. Keith Bourgeois could do the operation, he said, but a comp...

© 2025 Deschenes Financial Services, Inc. All right reserved.

By creating a profile, you agree to receive communications from us via email or phone regarding insurance offers for you and your family.