Action Plan to provide safe, lower cost drugs to consumers

President Trump has been clear: for too long American patients have been paying exorbitantly high prices for prescription drugs that are made available to other countries at lower prices.

President Trump has been clear: for too long American patients have been paying exorbitantly high prices for prescription drugs that are made available to other countries at lower prices.

Earlier this year, insurance regulators from both Texas and Washington state filed orders against Aliera Healthcare, a health care sharing ministry (HCSM), after some of its members filed complaints about denied or delayed payments on their medical claims.

Earlier this year, insurance regulators from both Texas and Washington state filed orders against Aliera Healthcare, a health care sharing ministry (HCSM), after some of its members filed complaints about denied or delayed payments on their medical claims.At first glance, this m...

Democrats claim they’re protecting the public from what Sen. Chuck Schumer calls “j...

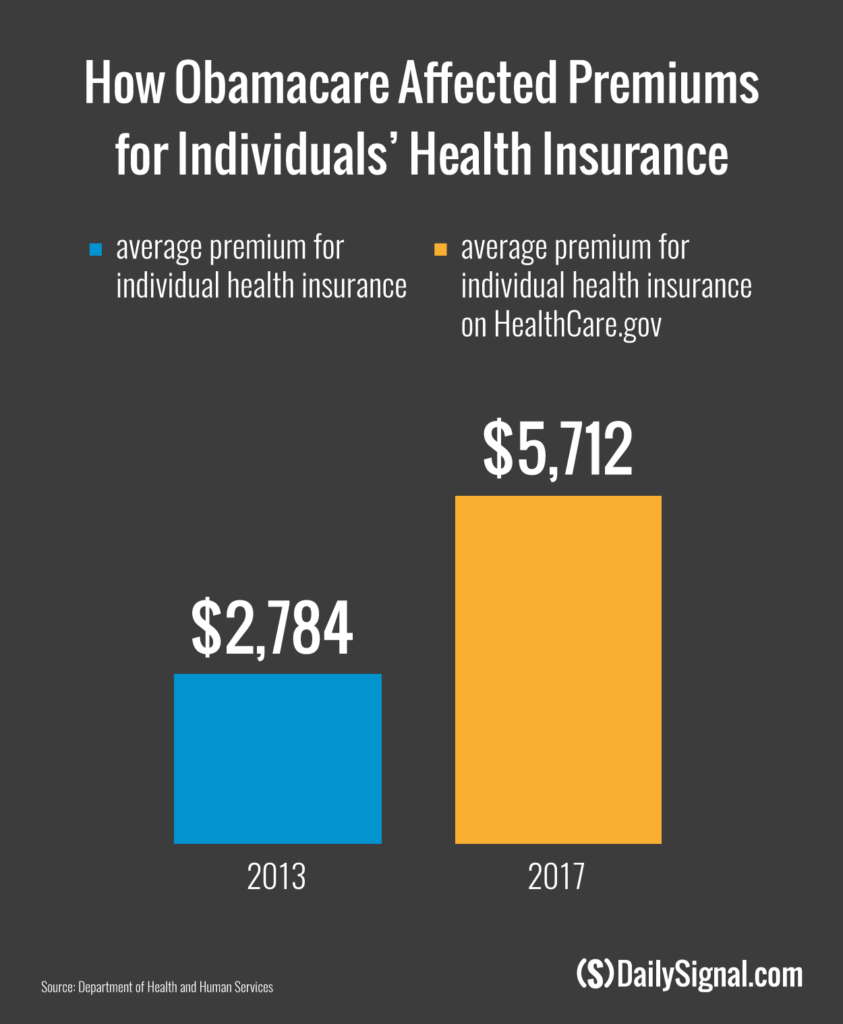

For the first time since the enactment of Obamacare, people will be able to buy insuran...

© 2025 Deschenes Financial Services, Inc. All right reserved.

By creating a profile, you agree to receive communications from us via email or phone regarding insurance offers for you and your family.