Small Employers Cut Health Care Costs Using Stand-Alone HRAs

Qualified small employer HRAs are a low-cost alternative to group coverage

By Stephen Miller, CEBSApr 9, 2018

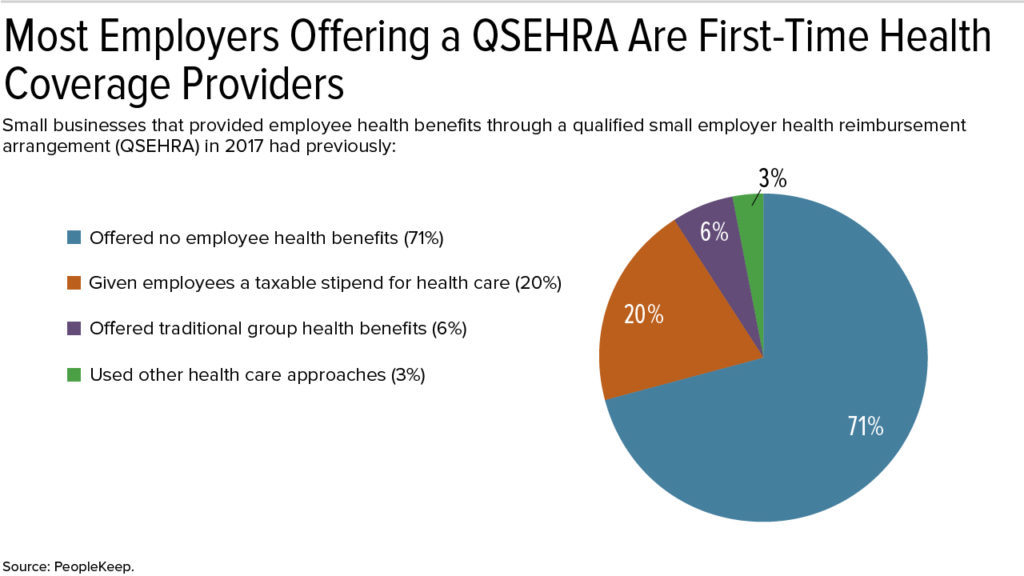

More than 70 percent of small businesses that used a new type of health reimbursement arrangement (HRA) last year did so to offer employee health benefits for the first time, a new study shows. These early adopters also spent less on health benefits than small employers that provide employees with group health coverage.

The qualified small employer HRA (QSEHRA), created by Congress in December 2016, is a way for small businesses with fewer than 50 full-time employees to offer nongroup health benefits. By using a stand-alone QSEHRA, small employers can offer their workers a tax-free monthly contribution to purchase their own health care policies, either through an insurance broker or on the Affordable Care Act (ACA) marketplace exchange.

If the premium is greater than the employer's monthly contribution, however, the employee pays the difference. If the contribution is more than the monthly premium, employees can use the extra funds to pay for out-of-pocket health costs, as they would do with a traditional HRA.

Employers with fewer than 50 full-time or equivalent employees are not subject to the ACA's employer mandate, which requires large employers to provide most full-time employees with ACA-compliant group coverage. The outlook for legislation that would allow large employers to pay premiums for individual policies through a QSEHRA, or regulatory guidance that would ease HRA restrictions to allow this, remains uncertain.

Lower Employer Costs

"There are many reasons small businesses choose to offer personalized health benefits like the QSEHRA, but one of the biggest reasons is cost," said Caitlin Bronson, a content specialist at Salt Lake City-based PeopleKeep, a benefits software company. "Thanks to rising costs and increasing government regulation, traditional group health benefits have become too expensive, too complex and too one-size-fits-all for most small businesses," she noted.

Bronson authored The QSEHRA: Annual Report 2018, which analyzed data from more than 600 small businesses and nearly 4,000 employees who were early adopters of the QSEHRA benefit last year.

Average monthly QSEHRA employer contribution amounts, the data showed, were:

- 38 percent smaller than the average small-employer contributions to group premium plans for single coverage.

- 47 percent smaller than average small-employer contributions to group premium plans for family coverage.

Small employers offering a QSEHRA in 2017 gave an average monthly contribution of:

- $280.20 per employee with self-only coverage.

- $476.56 per employee with family coverage.

In comparison, small businesses that offered group health insurance coverage spent an average $454.67 per employee per month for single coverage and an average $900.08 per employee per month for family coverage, according to the 2017 Employer Health Benefits Survey by the nonprofit Kaiser Family Foundation.

The IRS issues annual contribution limits for QSEHRAs, and last year nearly a quarter (22 percent) of participating employees received the 2017 maximum monthly contribution of $412.50 for self-only coverage or $833.33 for family coverage, PeopleKeep found.

For 2018, the monthly maximum QSEHRA limits are $420.83 for self-only and $854.16 for family coverage.