Air Ambulances Are Flying More Patients Than Ever, and Leaving Massive Bills Behind

Rising prices, billing disputes, and a quirk in federal law are creating a new health-care headache.

When three-year-old West Cox’s fever hit 107 degrees, doctors called a helicopter.

Hours earlier, the toddler, who’d been prescribed an antibiotic for a suspected ear infection, was at home in Princeton, West Virginia, watching cartoons and eating chips and salsa. Then, during a nap, he started to have convulsions, and his mother, Tabitha Cox, a physician assistant, drove him to the emergency room, stripped to his shorts to cool. Tabitha remembers the triage nurse’s eyes widening when she took West’s temperature at Princeton Community Hospital, the only medical center in the small town on the southern edge of the state. Nurses covered him in ice packs to try to keep his temperature down. Patients running a fever that high can suffer permanent brain damage. Within an hour of his arrival at the emergency room, an air ambulance was on the way to take West to the CAMC Women and Children’s Hospital in Charleston. Flying would cut a 90-minute drive in half. During four nights in the pediatric intensive-care unit, West recovered from apparent encephalitis. Three years later, his parents are still reckoning with the aftermath of his 76-mile flight: a bill for $45,930 from for-profit helicopter operator Air Methods. At the heart of the dispute is a gap between what insurance will pay for the flight and what Air Methods says it must charge to keep flying. Michael Cox, West’s father and a track coach at Concord University, had health coverage through a plan for public employees. It paid $6,704—the amount, it says, Medicare would have paid for the trip. Air Methods billed the family for the rest.

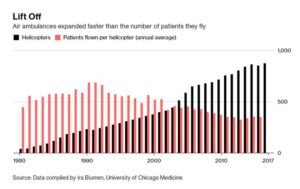

The U.S. air-ambulance fleet has doubled in size in the past 15 years to nearly 900 helicopters making 300,000 flights annually, according to data compiled by Ira Blumen, a professor of emergency medicine and director of University of Chicago Aeromedical Network.

That rapid growth has made stories such as the Cox family’s more common. The air-ambulance industry says reimbursements from U.S. government health programs, including Medicare and Medicaid, don’t cover their expenses. Operators say they thus must ask others to pay more—and when health plans balk, patients get stuck with the tab.

“I was angry and I felt like we were being taken advantage of,” said Tabitha Cox. The family sued Air Methods in August 2017, seeking certification for a class-action lawsuit against the company on behalf of other patients in West Virginia who received similar bills.

Air Methods has defended its billing and disputed other allegations in the complaint in court filings. The case is pending.

“The fundamental problem is that the current reimbursement rates by Medicare, Medicaid, and some of the private insurance companies fall well short of what it actually costs to provide this lifesaving service,” Air Methods Executive Vice President JaeLynn Williams said in an interview. She declined to comment on specific patients’ cases.

Air Methods billed the family for the rest.

The U.S. air-ambulance fleet has doubled in size in the past 15 years to nearly 900 helicopters making 300,000 flights annually, according to data compiled by Ira Blumen, a professor of emergency medicine and director of University of Chicago Aeromedical Network.

That rapid growth has made stories such as the Cox family’s more common. The air-ambulance industry says reimbursements from U.S. government health programs, including Medicare and Medicaid, don’t cover their expenses. Operators say they thus must ask others to pay more—and when health plans balk, patients get stuck with the tab.

“I was angry and I felt like we were being taken advantage of,” said Tabitha Cox. The family sued Air Methods in August 2017, seeking certification for a class-action lawsuit against the company on behalf of other patients in West Virginia who received similar bills.

Air Methods has defended its billing and disputed other allegations in the complaint in court filings. The case is pending.

“The fundamental problem is that the current reimbursement rates by Medicare, Medicaid, and some of the private insurance companies fall well short of what it actually costs to provide this lifesaving service,” Air Methods Executive Vice President JaeLynn Williams said in an interview. She declined to comment on specific patients’ cases.

Favorable treatment under federal law means air-ambulance companies, unlike their counterparts on the ground, have few restrictions on what they can charge for their services. Through a quirk of the 1978 Airline Deregulation Act, air-ambulance operators are considered air carriers—similar to Delta Air Lines or American Airlines—and states have no power to put in place their own curbs.

Prices for emergency medical flights have increased dramatically, as air-ambulance operators expanded their networks and responded to a wider set of emergencies, including traumas, strokes and heart attacks. The median charge to Medicare for a medical helicopter flight more than doubled to almost $30,000 in 2014, from $14,000 in 2010, according to a report last year by the U.S. Government Accountability Office. Air Methods’ average charge ballooned, from $13,000 in 2007 to $49,800 in 2016, the GAO said. Medicare, the federal health program for people 65 and older, pays only a fraction of billed charges; Medicaid, the state-federal program for the poor, pays even less. Air-ambulance operators’ special legal status has helped them thwart efforts to control their rates. West Virginia's legislature passed a law in 2016 capping what its employee-health plan—which covered West Cox—and its worker-compensation program would pay for air ambulances. Another company, Air Evac EMS, successfully challenged the caps in federal court. A judge ruled that the caps were pre-empted by the federal deregulation law and blocked the state from enforcing them. West Virginia has appealed the ruling. The industry has used similar arguments to fight regulation in other states, winning cases in North Carolina, North Dakota, Texas and Wyoming. A lawsuit recently filed in New Mexico challenges the state’s prohibition on balance billing on the same grounds. Wealthy investors lured by the industry’s rapid growth have acquired many of the biggest air-ambulance operators, leaving control of the business in the hands of private-equity groups. American Securities LLC bought Air Methods for $2.5 billion in March 2017. Rival Air Medical Group Holdings, which includes Air Evac and several other brands, has been owned by New York private-equity firm KKR & Co. LP since 2015. Two-thirds of medical helicopters operating in 2015 belonged to three for-profit providers, the GAO said in its report. Amy Harsch, a managing director at American Securities, declined to comment. Kristi Huller, a spokeswoman for KKR, declined to comment. Seth Myers, president of Air Evac, said that his company loses money on patients covered by Medicaid and Medicare, as well as those with no insurance. That's about 75 percent of the people it flies. “I fly people based on need, when a physician calls or when an ambulance calls,” he said. “We don’t know for days whether a person has the ability to pay.” According to a 2017 report commissioned by the Association of Air Medical Services, an industry trade group, the typical cost per flight was $10,199 in 2015, and Medicare paid only 59 percent that. Air-medical operators back U.S. legislation proposed by Senator Dean Heller of Nevada and Representative Jackie Walorski of Indiana, both Republicans, that would boost reimbursements by as much as 20 percent over three years. The bill would also have Medicare collect cost data from air-ambulance companies and use it to update rates to reflect “the actual costs of providing air ambulance services.” Both versions have co-sponsors from both parties.

According to a 2017 report commissioned by the Association of Air Medical Services, an industry trade group, the typical cost per flight was $10,199 in 2015, and Medicare paid only 59 percent that. Air-medical operators back U.S. legislation proposed by Senator Dean Heller of Nevada and Representative Jackie Walorski of Indiana, both Republicans, that would boost reimbursements by as much as 20 percent over three years. The bill would also have Medicare collect cost data from air-ambulance companies and use it to update rates to reflect “the actual costs of providing air ambulance services.” Both versions have co-sponsors from both parties.

For people with private insurance, short flights in an air ambulance are often followed by long battles over the bill.

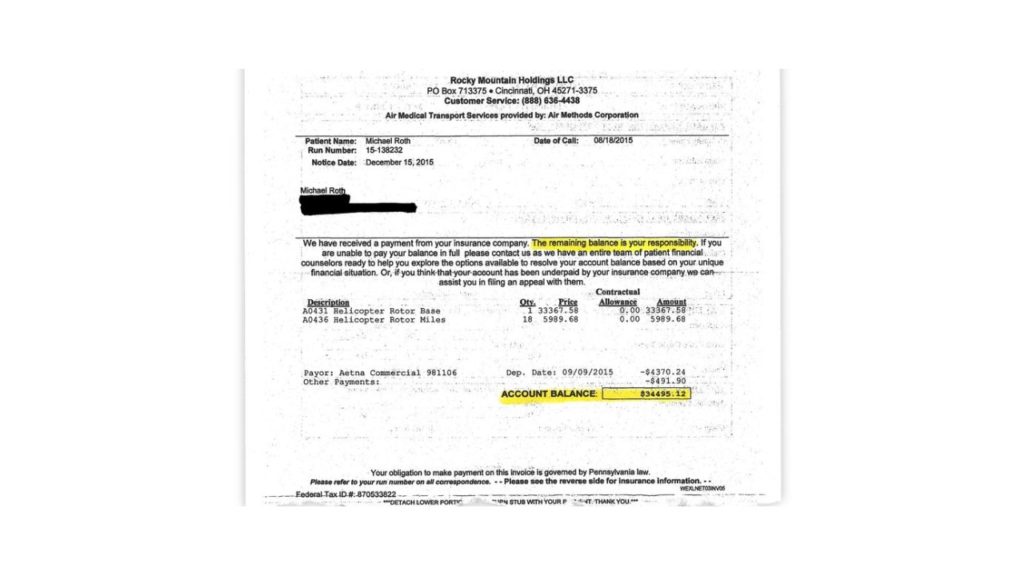

In 2015, Erin Roth’s father, Michael, was flown 18 miles by helicopter from Good Samaritan Hospital in Suffern, New York, to Westchester Medical Center in White Plains, after he collapsed on a work site and hit his head. Roth, who was 55, died from his injury. After workers-compensation insurance refused to cover the flight, his Aetna Inc. medical plan paid $4,370, and Air Methods’ subsidiary, Rocky Mountain Holdings LLC, sent the family a bill for $34,495. The air-ambulance company put a lien on Roth’s estate, preventing Erin from selling her father’s house. The dispute dragged on for two years, until a TV reporter Roth contacted looked into it, and Aetna paid the rest of the claim. “It was just kind of like a black cloud that was over my head the whole time,” she said.

Air Methods and Aetna declined to comment on Roth’s situation.

Williams, Air Methods’ executive vice president, said the company has hired “nearly 25” patient advocates since 2016 to “help them navigate the very complex process with their insurers, and we help them get the payments for these lifesaving critical emergency services that they’re entitled to.”

The industry says insurers put patients in the middle. “We need to hold the insurers’ feet to the fire to say we need a reasonable rate,” said Myers, the Air Evac executive. He said health plans often won't agree to network contracts that could lower costs. He declined to say how large in-network discounts are, citing nondisclosure agreements.

Consumer groups and insurers counter that air-ambulance companies strategically stay out of health-plan networks to maximize revenue.

In response to a complaint filed with the state insurance commissioner by a West Virginia consumer last year, insurer Highmark Blue Cross Blue Shield wrote that it tried to negotiate a contract with Air Methods, but the company “refuses to discount its services by more than 3% of its total charge.” The consumer was appealing a $51,209 bill for his daughter’s medical flight, of which Highmark paid $10,571.

Williams, the Air Methods executive, declined to comment on what discounts the company offers insurers, but she said it is in “active negotiation” with about a dozen insurers nationally.

“Air Methods is 100 percent committed to going in-network,” she said.

Air-ambulance providers are “using consumers as leverage with the insurance companies,” said Betsy Imholz, director of special projects at Consumers Union, who helped write a report critical of the industry. Patients are “terrified” when they receive a five-figure bill for an air ambulance and press insurers to pay more, she said.

“I think there is, frankly, in many cases, price gouging going on,” Imholz said.

“It was just kind of like a black cloud that was over my head the whole time,” she said.

Air Methods and Aetna declined to comment on Roth’s situation.

Williams, Air Methods’ executive vice president, said the company has hired “nearly 25” patient advocates since 2016 to “help them navigate the very complex process with their insurers, and we help them get the payments for these lifesaving critical emergency services that they’re entitled to.”

The industry says insurers put patients in the middle. “We need to hold the insurers’ feet to the fire to say we need a reasonable rate,” said Myers, the Air Evac executive. He said health plans often won't agree to network contracts that could lower costs. He declined to say how large in-network discounts are, citing nondisclosure agreements.

Consumer groups and insurers counter that air-ambulance companies strategically stay out of health-plan networks to maximize revenue.

In response to a complaint filed with the state insurance commissioner by a West Virginia consumer last year, insurer Highmark Blue Cross Blue Shield wrote that it tried to negotiate a contract with Air Methods, but the company “refuses to discount its services by more than 3% of its total charge.” The consumer was appealing a $51,209 bill for his daughter’s medical flight, of which Highmark paid $10,571.

Williams, the Air Methods executive, declined to comment on what discounts the company offers insurers, but she said it is in “active negotiation” with about a dozen insurers nationally.

“Air Methods is 100 percent committed to going in-network,” she said.

Air-ambulance providers are “using consumers as leverage with the insurance companies,” said Betsy Imholz, director of special projects at Consumers Union, who helped write a report critical of the industry. Patients are “terrified” when they receive a five-figure bill for an air ambulance and press insurers to pay more, she said.

“I think there is, frankly, in many cases, price gouging going on,” Imholz said.

When air travel was deregulated, the air-ambulance business was in its infancy. A few dozen medical helicopters, mostly operated by hospitals, were in use in the early 1980s, according to data compiled by Blumen, the University of Chicago emergency-medicine professor.

Then, in 2002, a new Medicare payment formula “effectively raised the payment amounts for air ambulance service,” according to the GAO. At the same time, new treatments for strokes and heart attacks expanded the number of patients who could survive such episodes if medics got to them sooner. As rural hospitals closed, air ambulances became lifelines for remote communities. The number of aircraft grew faster than the number of patients flown. In the 1990s, each helicopter flew about 600 patients a year, on average, according to Blumen’s data. That's fallen to about 350 in the current decade, spreading the expense of keeping each helicopter at the ready among a smaller pool of patients. While adding helicopters has expanded the reach of emergency care, “there are fewer and fewer patients that are having to pay higher and higher charges in order to facilitate this increase in access,” Aaron D. Todd, chief executive officer of Air Methods, said on an earnings call in May of 2015, before the company was taken private. “If you ask me personally, do we need 900 air medical helicopters to serve this country, I'd say probably not,” he said.Despite the apparent glut, air-ambulance operators are profitable. Air Methods had an average annual profit margin of 9.1 percent from 2012 to 2016. Over the same period, companies in the S&P 500 Health Care Providers & Services index had margins of 7.9 percent, on average. PHI, a helicopter company that operates both medical flights and transports for oil and gas drillers, reported average operating margins of 15.7 percent from 2014 to 2017 in its medical segment, compared to 10.4 percent for the benchmark index in the same period.

Air Methods declined to comment on its current profitability or to share financial details as a private company. If there are too many helicopters for the number of patients who need them, market forces should force less-efficient operators out of business, said Hank Perritt, a professor at the Chicago-Kent College of Law who has studied the industry. Montana Senator Jon Tester, a Democrat, has introduced legislation that would roll back the special status of air-ambulance companies. A Federal Aviation Administration reauthorization bill passed by the House in April would make medical services provided by air ambulances subject to state regulation. In West Virginia, the Cox family went through two appeals with their health plan. After they retained a lawyer, Air Methods offered to reduce their balance to $10,000 on reviewing their tax returns, bank statements, pay stubs, and a list of assets. The family decided to sue instead. “I felt like they were screening us to see just how much money they could get out of us,” Tabitha Cox said. “I think about people that really struggle—single moms, people that don’t have the financial blessings that we have. Bottom line, it’s just not fair.”