Understanding the Differences Between Living Benefits Policies: Not All Have the Same Triggers

Not All Living Benefits Plans Have the Same Triggers!

Understanding the difference is really important.

When it comes to Living Benefits Life Insurance Policies, there is a difference between 1st generation plans that have 6-8 or 10 triggers and 2nd generation plans that have 16-17 triggers. Living benefits pays off early, in some cases years early, an accelerated portion of your death benefit. People use this money to live on and pay expenses. Having more triggers makes the money accessible to you in more ways - and that is a good thing.

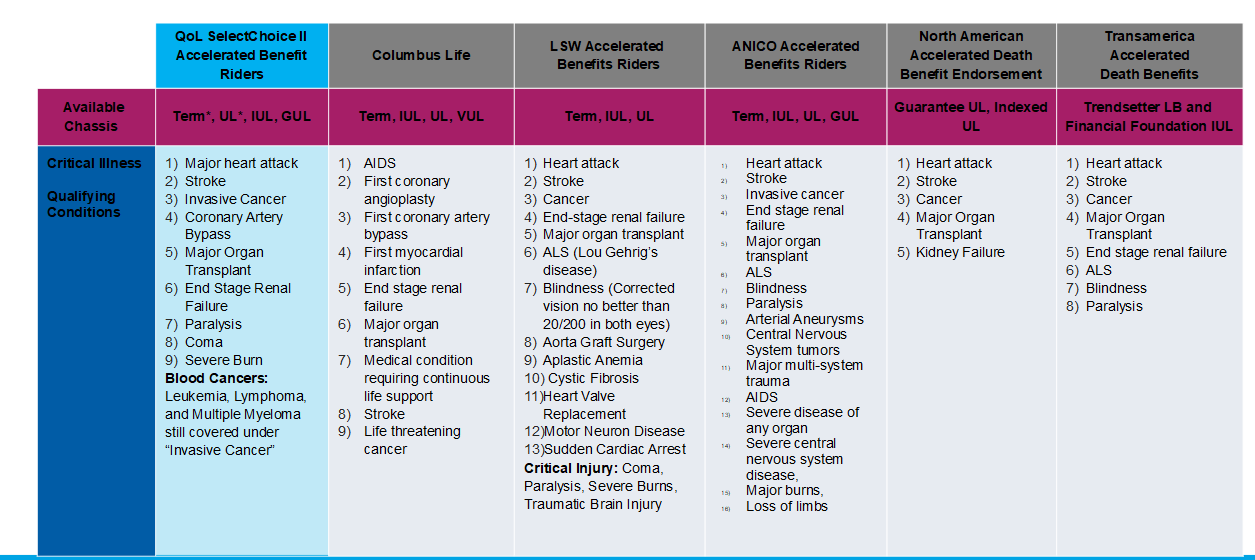

Here are the plans that are available and the triggers that are written into each plan:

PHOENIX has 6 Critical Illness Triggers

Phoenix Chronic Illness

Phoenix Critical Illness

Phoenix Terminal Illness

Transamerica has 8 Critical Illness Triggers

Transamerica Chronic Illness - Up to $1.5 Million

Transamerica Critical Illness

Transamerica Terminal Illness

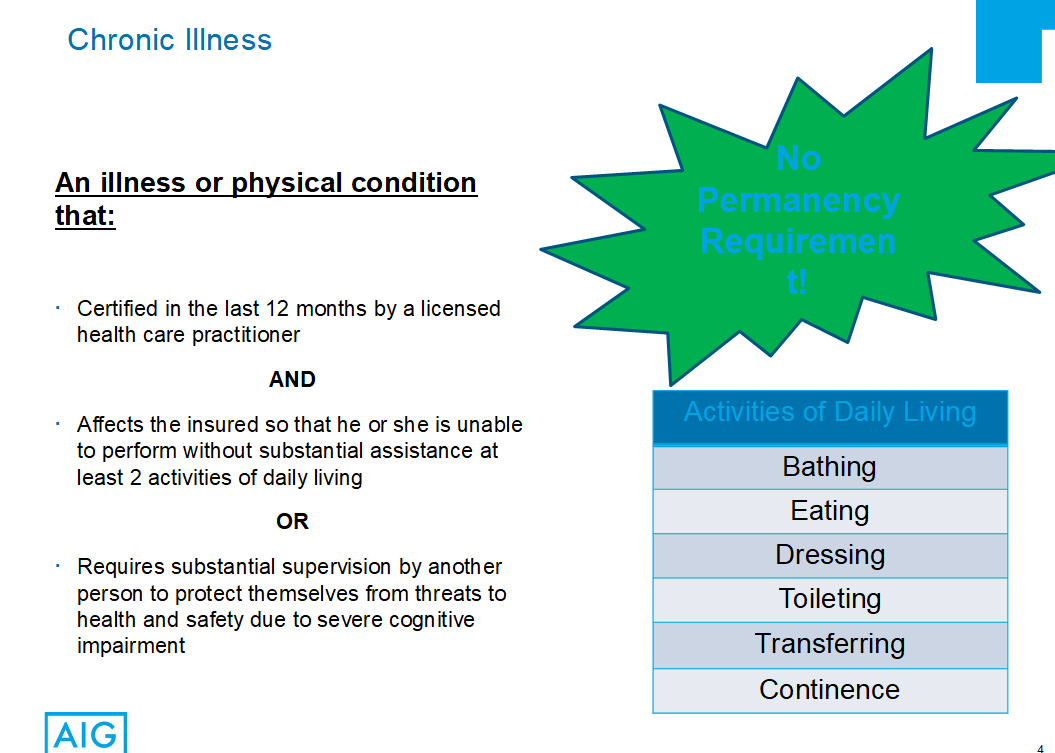

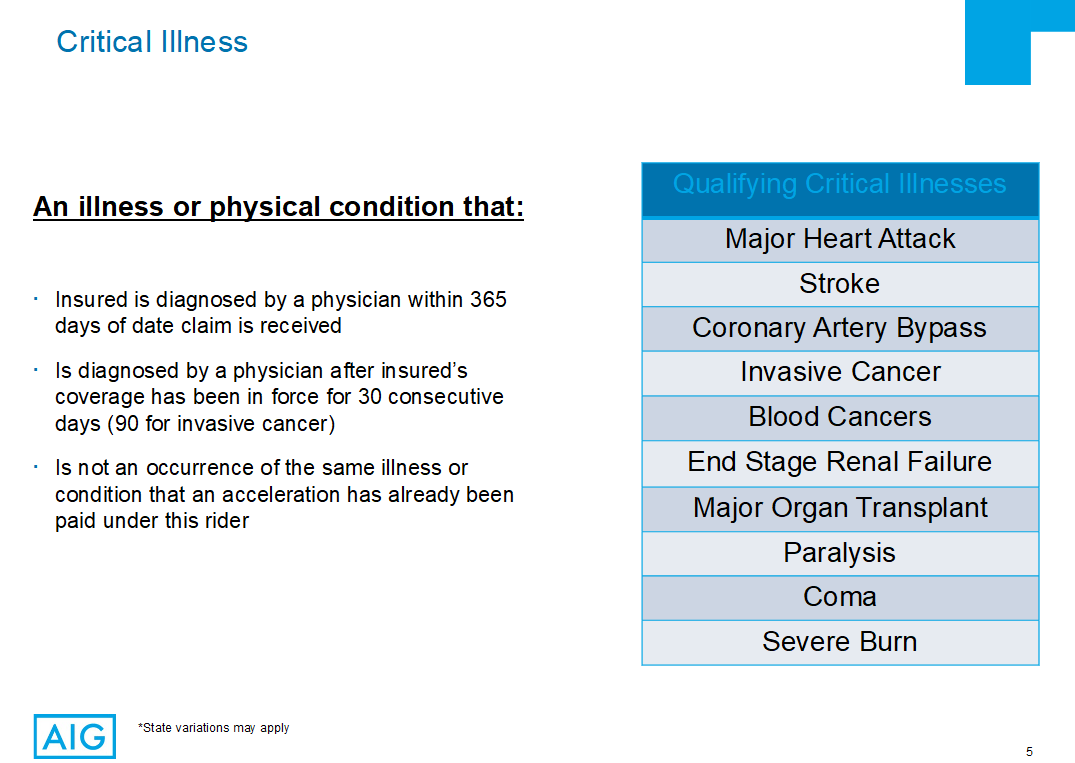

AIG has 10 Critical Illness Triggers

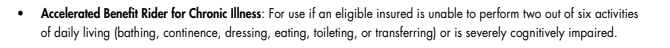

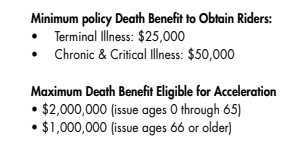

AIG Chronic Illness - Up To $2 Million

AIG Critical Illness

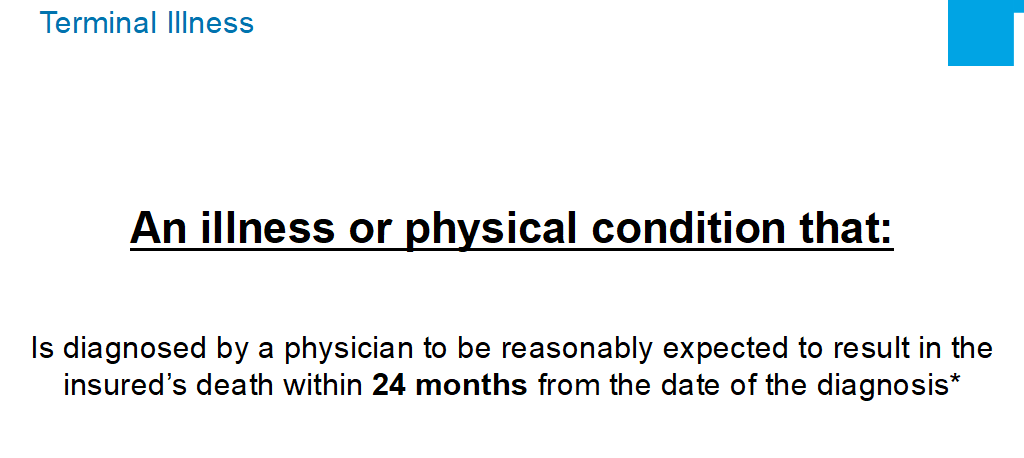

AIG Terminal Illness - 24 Months

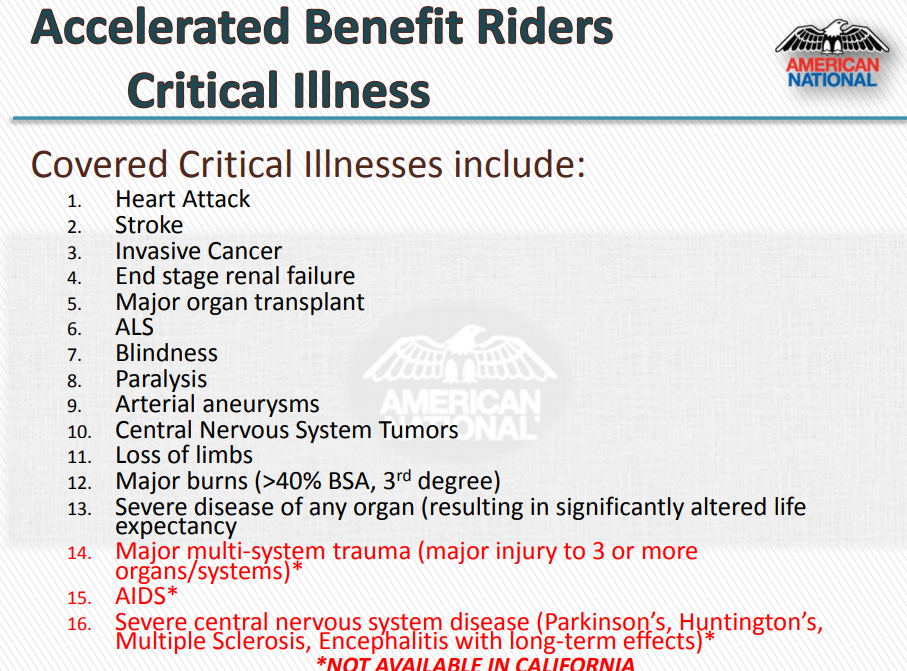

American National ("ANICO") has 16 Critical Illness Triggers

ANICO Chronic Illness

ANICO Critical Illness

ANICO Terminal Illness - In Texas - 24 Months

Winner!

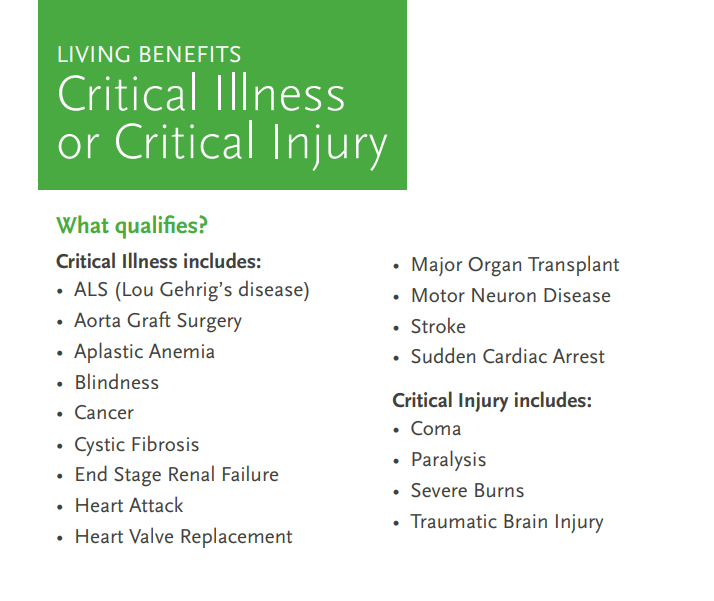

National Life Group ("NLG") has 17 Triggers Critical Illness & Injury

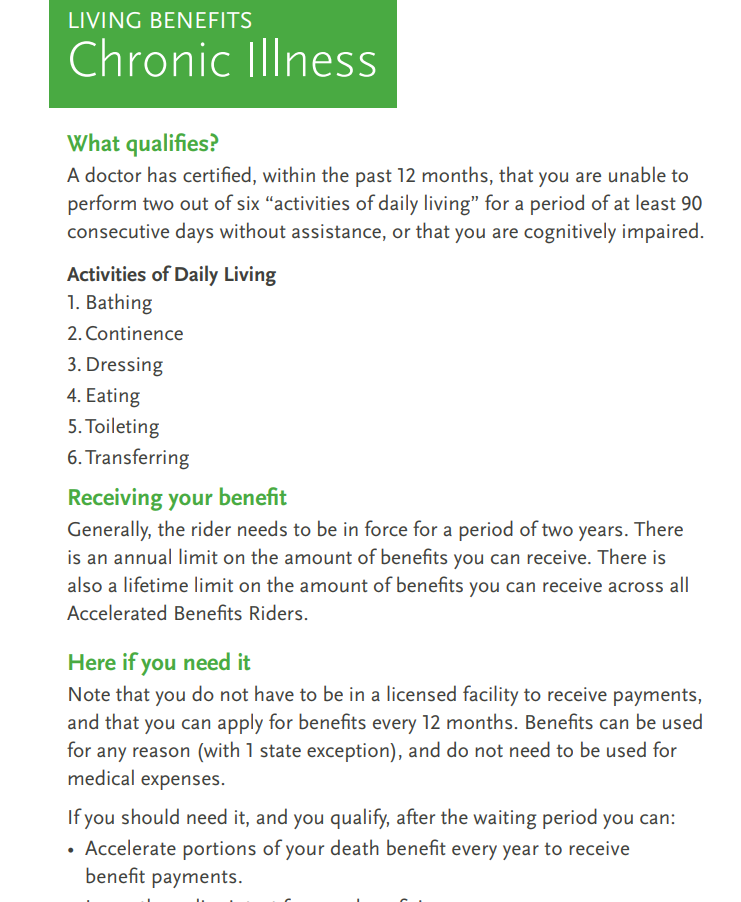

NLG Chronic Illness

NLG Critical Illness

Summary Chart