When it Comes To Health Insurance: You Need A Strategy

It's not enough to "Buy Health Insurance" What you have to have is a strategy.

When it comes to health insurance people often bounce between quality and price. They don't know what they really need...they don't understand the industry...they find health insurance confusing and frustrating.

More importantly, most people don't understand that when it comes to insurance (and most important your emergency plan!) You need an overall strategy.

When helping clients I recognize that woman and moms want:

- Checkups

- Shots

- Female checkups

- No hassles

Men want:

- Price

- Then later they get frustrated when they have to pay a chunk

- So they end up bouncing back and forth between high and low-cost policies

Here's the strategy you need

Over my 30 years as an agent, I've learned that it's all about figuring out what you want to insure FOR:

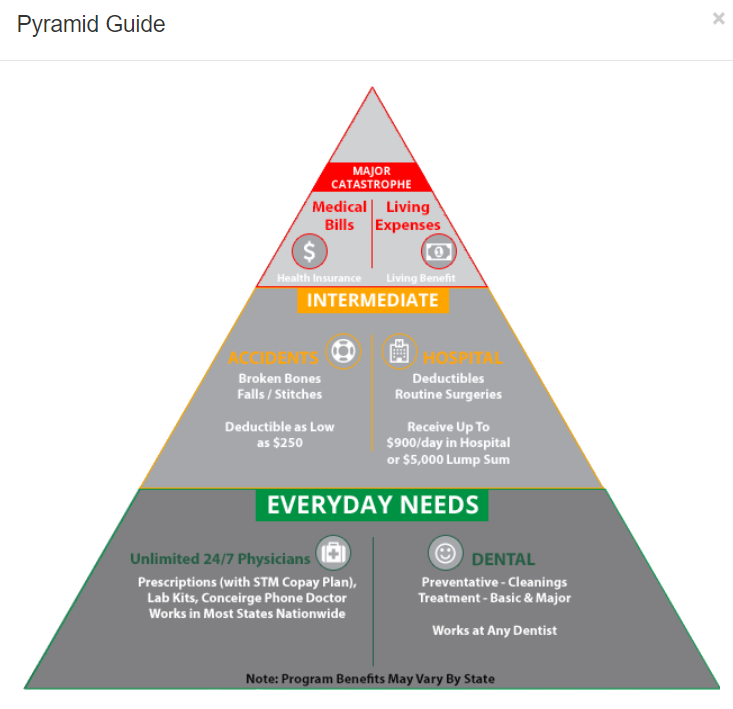

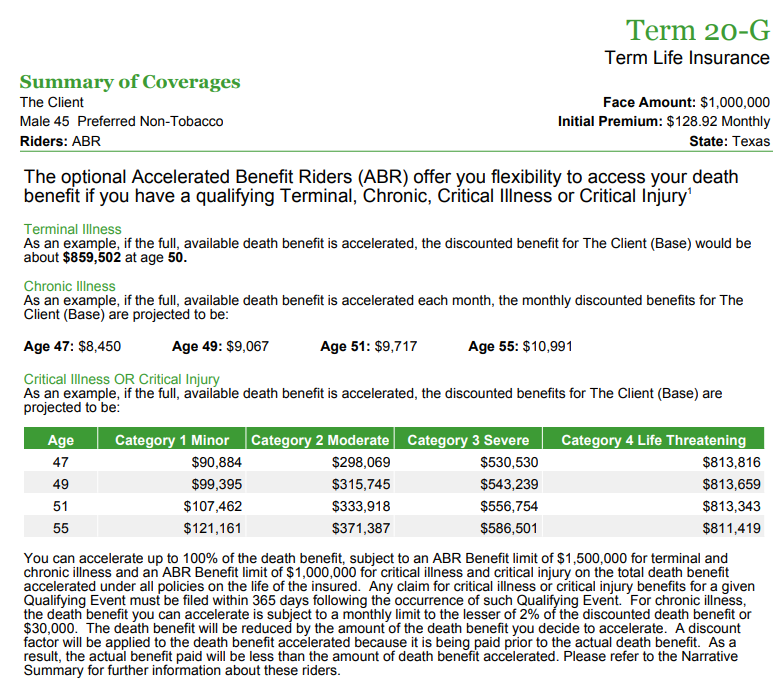

Using the graphic as a guide, ask yourself which areas do you want to cover?

To cover the Catastrophic in Red at the top left you'll need a major medical plan. NOT a fixed benefit, NOT a Christian Sharing, but a Major Medical comprehensive plan. Something that will actually pay the claim with a high dollar limit of at least $250,000 a year.

A high deductible (say $5,000 ) is okay because that means a low premium (if you are talking Short Term Medical whare a family, depending on age, will be $250-$450-$600 per month depending on choice & geographic location). Short Term Medical is at least 50% less than Obamacare or Group. But, Short Term Medical does not cover pre-existing conditions such as Maternity. Nor does it cover most checkups. Short Term Medical ( "STM" ) is also limited duration with max 364 days (although some plans can be auto reapplied for up to a total of 3 years). However, STM is the affordable alternative for a healthy family compared to Obamacare or Group that costs $900-$3,000, even with high deductibles.

People that group or Obamacare:

- Don't know about STM,

- Have a serious pre-existing condition, or

- Just don't understand managing risk - by that I mean these plans cost 3 to 5 x as much premium.

Health Insurance and Managing Risk

Why pay an extra $10,000 per year to get your checkup for "free"? That really isn't free - is it?

If you are a healthy family with no pre-existing conditions why not take a part of the huge savings afforded by the STM and reserve for your expected medical needs like checkups? (The bottom of the pyramid). Everyday needs happen often but are NOT expensive when paid for in cash and are not a huge burden when you consider that the average person spends $500 a year or less on routine items (so a family of 4 will spend about $2000). Compare that to a $10,000 savings on premiums over a group or Obamacare individual plan! The extra $8000 in savings will make the "money person" in the household smile!

To keep the cash costs at $500 per person you have to be careful - which means, point-blank, you can't do things that are stupid. You will have to ask how much things cost before you agree to them. You need to:

- Ask for the cash price of services

- Use Goodrx.com to get discounts on your prescriptions at local pharmacies (not mail order)

- Use the school or county health dept for immunizations. For example, immunizations at a pediatrician for an infant can cost $700. At the Bexar County Immunization program, they are approx $34. Why do you need to pay more?

- Go directly to a lab for lab work related to checkups or managing conditions like diabetes. Why get it done at your doctor office? Normally they're not doing the lab - they are just drawing the blood, putting it in an envelope & the lab is picking it up. Instead, do it this way -- have the doctor write your lab order, go to healthcheckusa.com and pay 75% less for the labs...or go to the drawing station (there are dozens around town), have the results emailed to you, then send or take the results to your doctor.

This will save you thousands IF YOU ARE CAREFUL & wise -- it is no different than you shopping for an airline ticket.

Okay, we kind of bounced around from the top left catastrophic medical as everyone needs to be covered for the "big one"-- to everyday needs on the bottom like visits and checkups & scripts. Since we are down on the bottom - don't neglect your teeth - young people and older people alike need to keep a healthy mouth to maintain overall health. You've never seen a super healthy person with horrible teeth -- it just doesn't happen. Research shows that teeth and health are clinically connected.

Dental is easy. It's based upon who you want as your dentist -- YOUR DENTIST -- not ANY Dentist. If you want YOUR dentist you have to pick a plan he accepts. IF you want any guy in a white coat then easy just pick a PPO dental plan. Not much more need be said here other than some dental plans come with vision & they all have different limits on how much they pay a year. I have the best dental plans of each type on my website.

Now back to the Risk Pyramid - let's look at the middle, That middle is deductibles -- the threshold from which my Catastrophic plan begins to actually PAY. Notice I said PAY and not COVER. If your deductible is $5000 it didn't get PAID unless you paid it.

Going back to the savings over a Group or Obamacare plan. The savings almost always is substantially higher than your risk (deductible) but ---- what about special situations? Like young parents -- they have special situation because babies & toddlers don't have any common sense yet. They stick their fingers in door hinges and put marbles up their nose - and that results in an expensive urgent care or ER visit. BAMM mamma ain't happy-- daddy ain't happy and the credit card ain't happy. Lets make everyone happy by insuring at least the unexpected -

Accidents can be 100% reimbursed by an Accident Medical Expense ("AME") policy or Rider on the main plan. It's simple - just pick an accident coverage that matches your deductible and Voila no more deductible! This is a no brainer because the cost of Accident plans is cheap - normally about $32 a month, or about $400 a year for $5,000 benefit. Do the math in your head - are you SURE nothing will happen at all for the next 13 years (break-even point on cost of plan vs benefits - heck no - you ALWAYS need an accident rider! What 13-year-old kid has never been to the ER (broken an arm, fell off their bike and got a tooth knocked out - something - let alone a family of whatever size!). Now you don't need to buy it but BAM back to the unhappy credit card - again this is a strategy - very logical.

Let's look at another angle - the unexpected gallbladder, appendix, hysterectomy, the "routine" hospitalization if there is one - YEP I can protect Mr. Credit Card on that too - just give me $60 more per family or about $25 for a single and we reimburse $5000 of your deductible on the very first day you are admitted to the hospital. **To keep it legal - exceptions like mental, drug, alcohol reasons don't count - but you get the idea.

Before I summarize - I said (at least I thought I said) not a Christian sharing, not a fixed benefit--- boy BOTH of these are the areas that you get your shady Robo health insurance calls from.

Look, I've sold them but sparingly in very specific situations where the criteria - health, budget etc the "hard parameters" required it. 99% of the time they are NOT right for you. (They are right for me and pay about double the commission; but by now you should know I always treat you like family, not a victim). Here's why they are not right:

- Christian Sharing - no guarantee of payment and YOU MUST FRONT THE MONEY TO THE PROVIDER BECAUSE YOU ARE CONSIDERED SELF PAY. What that means is this -- oops you get cancer -- you want to go to the hospital to get treated -- you have Christian Sharing plan-- YOU MUST put a $40,000 deposit from your own cash down to get in the door -- don't have $40k sitting in your glove box? You pay the entire bill and then wait for months or never to get reimbursed. This is NOT a strategy -it's a recipe for bankruptcy.

- Fixed Benefit plans are another area of "corruption". Not in their function as they work perfectly - they do exactly what they say they will do - what is that? NO deductibles- immediate payout - low copays - covers some checkups. WOW! That sounds fantastic! And they are EXCEPT - what you don't hear on the ROBO call is they pay UP TO X dollars and STOP paying.

An example: they pay $2000 a day for a hospital - or $100 for a doctor visit (up to 3 visits) or you have a $20 copay for drugs ( the generic ones you could have got for $4 without it). These plans are okay if you HAVE a major medical and are not willing to budget for the everyday needs - but they generally do not represent value. The rare occasions I use them are either in combination with an STM or when someone is so sick they can't get an STM and the flat out can't afford Group or Obamacare - this as "well it is better than nothing".

OK - thanks for your time and patience! Hope you're enjoying and learning!

We forgot the MOST IMPORTANT area of coverage besides the STM itself

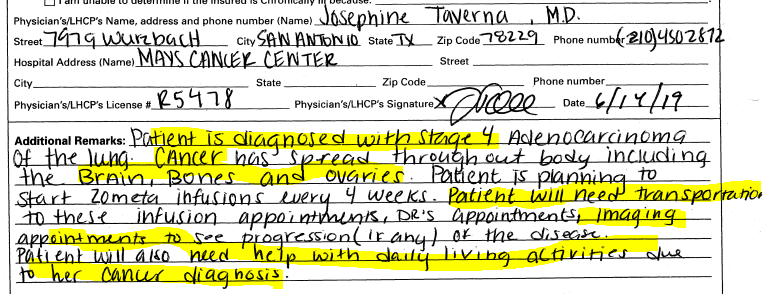

The Risk Pyramid says living expenses but it's really more than that. Imagine this is YOU (it is an actual client)

Point blank, earlier I talked about budgeting -- you can't budget for this -- no one can!

The patient has cancer and needs transportation, imaging, and help with daily living activities. This means you're in serious trouble both medically and financially. Your health insurance doesn't pay for a home nurse 24 hours. It doesn't pay for your transport, and if it's an STM plan it may not last as long as YOU DO. (You have a 1 or 2-year plan duration and your cancer diagnosis is a life event. It's not insurable on an STM until 5 years AFTER you recover.) Some of us will die - some will live - but either way you need money to live on and money for your family to live on. Plus you'll need to go back to an EXPENSIVE Obamacare or GROUP PLAN in about a year or so - and that will cost thousands of Dollars. Maybe you have to set up a group for your business since you don't want to be trapped in Obamacare (you know they are only HMO in Texas and that sucks). No matter this IS going to cost you or financially break you.

So here's the strategy you need to employ NOW before this happens. This strategy is low cost - but remember that these are just rough average numbers. Hold this in your mind while I lay out the strategy - The average family on Obamacare is $1400 a month.

Now compare that to the strategy:

- STM $400

- AME & Hospital $90

- Dental $100, well so far I am at $590

- We'll get a $1,000,000 term life plan for mom & dad-- depending on age/ tobacco/ health it is $40 to say $100 each

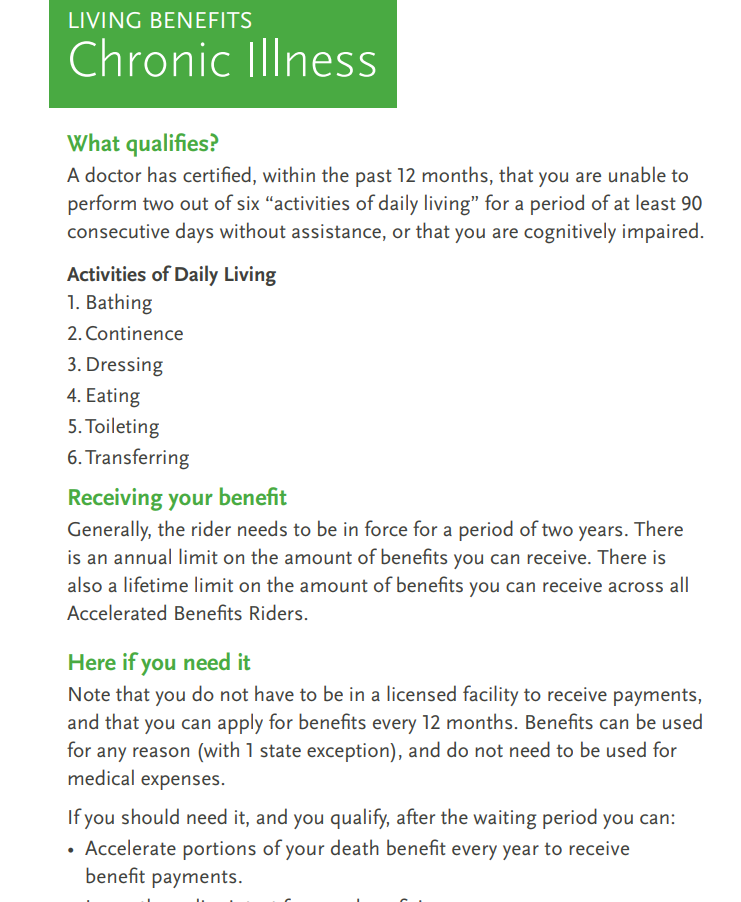

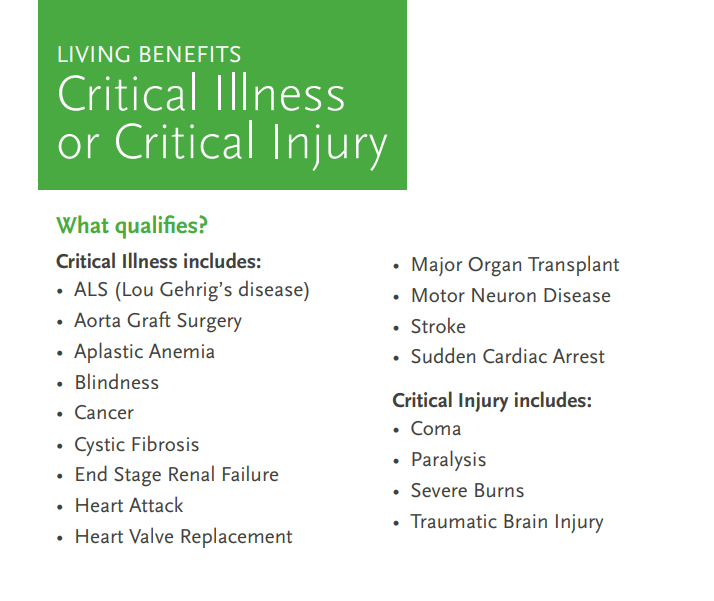

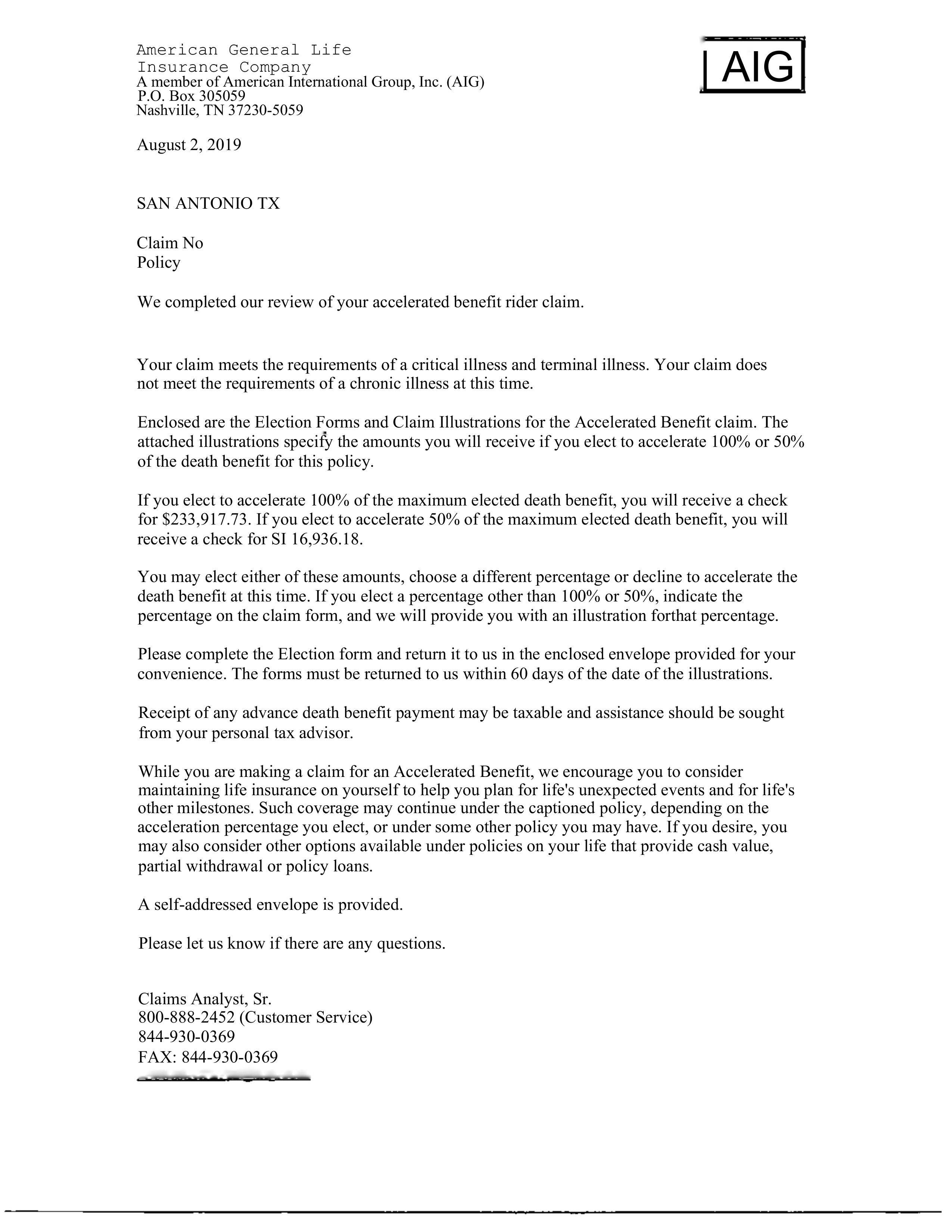

- So math wise I am at say $700 HALF OF OBAMACARE -- Except for one big difference -- Obamacare (besides the fact that you can't pick your specialists, hardly any providers accept it, it still has a $7900 out of pocket ( no gap or AME) no dental, that it cost 3x more for base medical. Overlook ALL of that ( which is impossible to do). IF you can overlook all those Obvious disadvantages -- the huge disadvantage -- or lets up spin this and say the huge advantage of STM is you CAN afford to buy a $1,000,000 living benefits term life plan that you otherwise wouldn't have. Seriously, do YOU have a $1,000,000 policy right now that will pay you this? Look for Chronic & Critical illness...here are the triggers of a popular plan

So the "big one' hits you -- it is on the list above -- YOU GET A CHECK----- NICE--

How big of a check? This is an example. Every person's situation is different, but the sicker you are the more you get. You will see below that the worse it is the bigger check. This is a Texas preferred second-best category male non-smoker age 45 example - but everyone gets a nice check.

Look at the payout - and oh yes - it also pays for Chronic illnesses like being disabled. And don't forget: if you just pass the spouse & family do get the cool $1,000,000.

So there you have it - the Strategy for the healthy family. If you have some members of your family that are not so healthy that's okay. I can do a hybrid approach - treating each person's needs individually is your strategy.

It is all about being prepared. If you respond better to video here is my video link.

Confused by health insurance? We have trusted solutions to your healthcare insurance needs, including long term care in the event of catastrophic illness. Call us today at 1-800-257-1723 or click here to schedule an appointment.

IMPORTANT!!! PS - Remember the cancer lady noted above? She bought the smallest $250k policy because she “didn’t need it but trusted me enough to get something" and bam 6 months later gets a check for the amount noted. Here's the letter:

Money used for comfort items allowed her husband to attend to her and funded the purchase of a group plan for their small business to continue coverage beyond the expiration of their short term medical (the affordable health insurance that made it possible to purchase the living benefits).

You see it came full circle:

- Opt-out of expensive Obamacare because you are healthy and save huge amounts of money

- Bank on your good health and purchase Short Term Medical (normally 1 yr at a time)

- Use the savings to purchase a gap plan for deductibles and a Living Benefit plan to provide an emergency fund if you suffer a Critical or Chronic Illness

- Keep repurchasing your short term every year until you don't qualify due to medical reasons

- IF that medical reason is a Critical or Chronic illness as it almost certainly is - then file a claim against your living benefits plan

- Receive a lump sum of cash

- Use the lump sum of cash to fund your return to Obamacare guaranteed issue insurance - with one exception - do a small group vs individual to gain PPO vs HMO and year-round access vs only 1 time a year open enrollment.

NOTE: Group plans can be expensive - most groups of 2 people range from $1500 to $2500 a month for a top policy. HOWEVER, you are back to those crazy Obamacare rates only because you are seriously ill, BUT you have saved money leading up to that illness, and, with the purchase of the living benefits plan, you re-enter Obamacare with potentially hundreds of thousands of dollars cash (like my other clients have).