Alcohol use can void your health insurance coverage

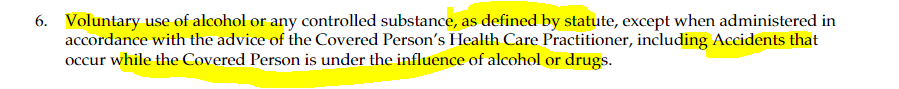

An Alcohol Exclusion Law (AEL) gives insurance companies the right to deny coverage to any person who, at the time of injury, seeks medical attention under the influence of alcohol or any drug not currently prescribed to them by a physician.

Texas currently has an Alcohol Exclusion Law in their insurance code. It is under the Uniform Accident and Sickness Policy Provision, UPPL, 1201.227: Intoxicants and Narcotics, for private insurance companies in Texas. The law even applies if alcohol is legally consumed and an injury is sustained.

Texas currently has an Alcohol Exclusion Law in their insurance code. It is under the Uniform Accident and Sickness Policy Provision, UPPL, 1201.227: Intoxicants and Narcotics, for private insurance companies in Texas. The law even applies if alcohol is legally consumed and an injury is sustained.

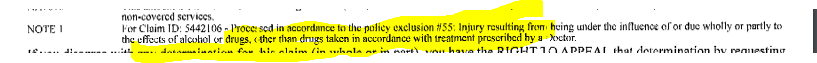

Texas State law Explicitly forbids payment of a claim that is alcohol or drug-related. If your medical providers coded your claim as alcohol or drug-related you will need to dispute the diagnosis if you believe it's incorrect.

Example One:

An older woman is celebrating her 25-year wedding anniversary with her family. She legally drinks some wine with her meal. They finish the celebration and along with her husband, she walks to their vehicle. On the way, she catches her heel in a crack in the sidewalk and falls, breaking her wrist in the process. She is transported to the emergency room and treated for her injuries. If the doctor issues a blood test and that test is positive for alcohol in her system, her insurance company can deny payment under the Alcohol Exclusion Law even though she was only walking to her car and did not break the law nor was she drunk.

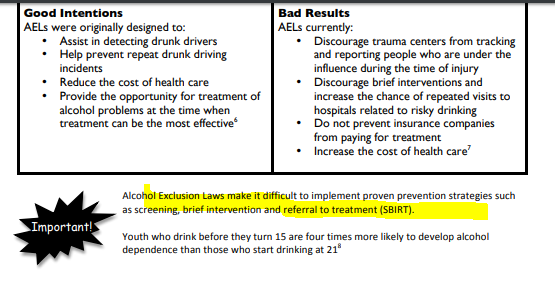

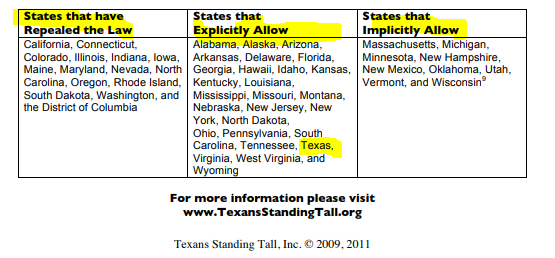

The National Association of Insurance Commissioners (NAIC), an organization of insurance regulators in the 50 states, adopted the Alcohol Exclusion Law as part of the UPPL model law in 1947.2 State could individually adopt this law as part of their insurance code should they choose. In 1955, Texas voted to make UPPL a part of the state insurance code. To date, 27 states explicitly allow Alcohol Exclusion Laws, 9 states implicitly allow Alcohol Exclusion Laws and 14 states plus the District of Columbia have prohibited the use of Alcohol Exclusion Laws.

Example Two:

A youth under age 21 falls while at a party. They hit their head on the ground and get a black eye. They are transported to the hospital for stitches and examination. The doctor and nurses smell alcohol on the youth. Because of the AEL, the youth is not screened to identify risky drinking behaviors; insurance covers the expense. A year later, the youth is at the ER for a broken wrist and again smelling of alcohol. The wrist is treated; insurance covers the costs: no data, no screening, and no intervention. The cycle continues.