New evidence that short-term plans offer good coverage for many.

Its Not ‘Junk’ Health Insurance

House Democrats last week voted to reverse a Trump Administration rule that the left has branded as promoting “junk insurance.” So note that the vote arrives the same week as a fresh analysis about how short-term health insurance can be a better option than ObamaCare.

House Democrats last week voted to reverse a Trump Administration rule that the left has branded as promoting “junk insurance.” So note that the vote arrives the same week as a fresh analysis about how short-term health insurance can be a better option than ObamaCare.

The Trump Administration last year allowed for short-term, limited-duration health insurance that can last up to a year. Plans can be renewed up to 36 months without new medical underwriting, which can protect against higher premiums if someone falls sick. The Obama Administration limited short-term insurance to three months to force everyone into the ObamaCare exchanges. The Trump crowd thought short-term plans could be viable for relatively healthy folks who earn too much for subsidies and are soaked by Affordable Care Act prices.

Democrats claim these are “garbage” plans designed to trick Americans. Speaker Nancy Pelosi tweeted this month that the Trump Administration “is fighting to replace many Americans’ health care with junk insurance policies that are allowed to discriminate against people with pre-existing conditions.”

Short-term offerings are nascent and several states ban them, with restrictions in about two dozen others, which limits data. But Chris Pope at the Manhattan Institute offered a useful comparison in a paper last week. Mr. Pope examines Fulton County in Georgia, where ObamaCare premiums hover around the national average and multiple insurers compete on the exchange. Short-term insurance is available, consistent with the new federal rules.

A Blue Cross bronze ObamaCare plan—which covers about 60% of medical expenses—for a 30-year-old male who doesn’t smoke runs $296 a month in premiums. The plan carries a $5,200 deductible, with a maximum out-of-pocket cost of $7,900. UnitedHealthcare’s short-term plan that lasts 360 days? Monthly premium: $209, nearly 30% lower. The deductible and out-of-pocket caps are also lower, at $5,000 and $7,000, respectively.

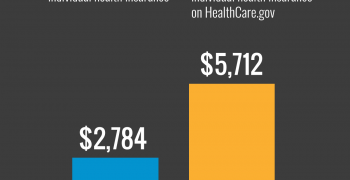

The savings are greater for a more generous silver plan: $467 a month in premiums on the exchange versus $250 for a comparable short-term plan. Mr. Pope says that while “narrow-network HMOs are often the only plans available through the ACA exchange,” short-term plans “tend to be PPOs that offer broader access to providers.”

Not every plan covers, say, mental health or prescription drugs, but many do, and not every customer wants to pay for every benefit. A February survey from eHealth found that 80% of those who bought short-term insurance said affordable premiums were more important than comprehensive benefits. Some 61% considered coverage that complies with the Affordable Care Act before looking at short-term options.

Democrats predicted that the short-term rule would siphon patients from the exchanges and send premiums soaring, which hasn’t happened. Mr. Pope notes that Affordable Care Act premiums increased 3% on average for 2019, and that 92 of 124 requested rate increases didn’t even mention short-term insurance as a significant factor in higher rates. The effect on premiums has been negligible.

Anyone with a tough medical condition and modest earnings will likely be better off on the exchanges, where coverage is generously subsidized. But plenty of Americans may conclude that short-term plans are better. The Democratic response to this individual choice? In the words of Senate Minority Leader Chuck Schumer: “Democrats will do everything in our power to stop this.”