Wondering If A Living Benefits Policy Is Right For You?

More insurers offer products to cover long-term care

Tom Anderson | @bytomanderson

An estimated 7 in 10 Americans will need some form of long-term care, and the costs can be staggering. But more insurers are starting to offer policies that could help ease the burden.

The median annual cost of a private room at a nursing house is $91,250, a private room at an assisted-living center is $43,200, and the median annual cost for a home health aide is $45,760, according to Genworth Financial, one of the largest providers of long-term care insurance.

And long-term care policies aren't cheap. A healthy, 55-year-old single man can expect to pay $1,060 per year in premiums for a long-term care insurance policy that's worth $164,000 in potential benefits, according to the American Association for Long-Term Care Insurance. The average cost for a 55-year-old single woman is $1,390 for the same amount of coverage. A 60-year-old married couple would pay $2,170 per year combined for a total of $328,000 of long-term care insurance coverage.

It's also gotten more difficult to buy a long-term care policy because many providers have left the market. A decade ago, more than 100 companies sold coverage, according to insurance trade association Limra. Last year, about two dozen companies sold long-term care policies.

In 2014, an estimated 131,000 such policies were purchased from carriers surveyed by Limra, down 24 percent from last year.

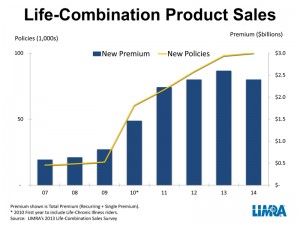

But long-term care insurance isn't the only way to fund long-term care expenses. Life insurance policies that offer long-term care coverage, known as life combination products or hybrid policies, are becoming an increasingly popular alternative. (See chart below.)

"Life combination products have experienced double-digit growth in the past five years," said Catherine Ho, a Limra product actuary. "These products clearly appeal to consumers who want a policy that provides flexible benefits and can address several of the financial risks consumers face as they grow older."

The main advantage of the life insurance combination product over a long-term care policy is that the buyer will get some benefit from the premiums even if long-term care coverage isn't needed.

Combination products can also be more affordable to buyers in their 60s than long-term care policies, said Chris Conklin, Genworth's senior vice president of product design.

"Life combination products have experienced double-digit growth in the past five years," said Catherine Ho, a Limra product actuary. "These products clearly appeal to consumers who want a policy that provides flexible benefits and can address several of the financial risks consumers face as they grow older."

The main advantage of the life insurance combination product over a long-term care policy is that the buyer will get some benefit from the premiums even if long-term care coverage isn't needed.

Combination products can also be more affordable to buyers in their 60s than long-term care policies, said Chris Conklin, Genworth's senior vice president of product design.

Life combination products are not standardized, and long-term care payouts vary widely depending on carrier and policy. So it's important to shop around and know exactly what your benefits will be if you require long-term care. You will also have to submit health information to the carrier to see if you qualify for coverage. As with standard long-term care coverage, the sooner you apply, the cheaper the policies may be, depending on your health.

Most life combination products require a single premium payment to begin coverage. To buy a meaningful long-term care benefit a person will have to write a check for $50,000 or more for a life combination policy, according to estimates from the American Association for Long-Term Care Insurance. Some carriers are allowing people to split their premium payments over two years, Ho said.

Carriers are still experimenting with better ways to cover long-term care costs, said Samantha Chow, senior life and annuities analyst at the Aite Group.

"Combination products allow less financially stable people to purchase long-term coverage," Chow said. "It's a relatively new market and insurers are still figuring it out."