Insurers Look to Ramp Up Premiums in Health Law Exchanges

Rate requests underscore struggles under ACA to enroll enough healthy people to offset costs of the sick

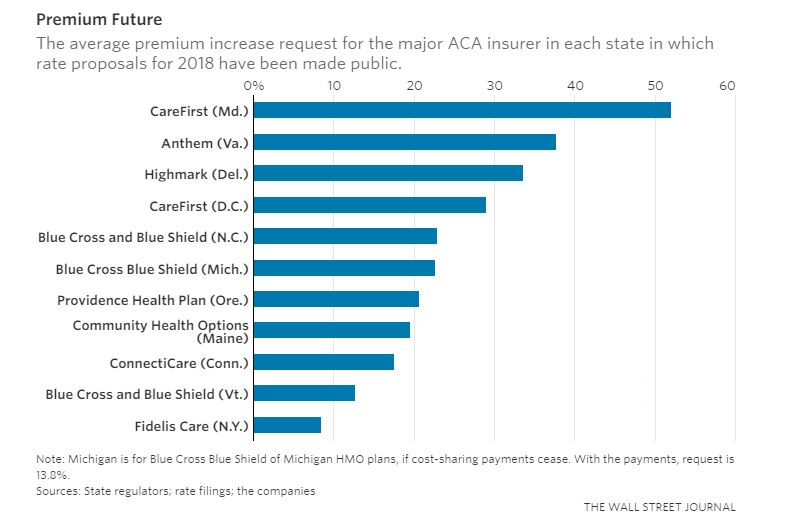

A growing number of major insurers are seeking premium increases averaging 20% or more for next year on plans sold under the Affordable Care Act, according to rate proposals in more than 10 states that provide the broadest picture so far of the strains on the marketplaces.

As Republicans try to pass a health-care bill to overhaul the ACA, the attention has focused on insurers’ withdrawals that may leave certain areas in at least a few states with no company selling coverage through the online insurance marketplace, or exchange, next year. But the rate requests by major insurers show stress on the marketplaces stretches beyond those trouble spots.

The biggest ACA-plan insurers in Delaware, Virginia and Maryland are asking for average increases greater than 30% for next year. In Oregon, North Carolina and Maine, the rate proposals from market leaders were around 20% or higher.

The insurers’ proposals reflect continuing struggles under the 2010 health law to enroll enough healthy people to offset the costs of the sick—but also uncertainty at the federal level about the law’s future. Insurers are particularly concerned about the fate of federal government payments that are used to reduce out-of-pocket costs like deductibles for low-income ACA-plan enrollees, which the Trump administration has threatened to halt, and enforcement of the individual mandate meant to prod young, healthy people to buy insurance.

“It’s still a very volatile market,” said Rick Notter, an executive at Blue Cross Blue Shield of Michigan. “There are so many uncertainties.” The market in his state isn’t stable, he said, but the problems are being exacerbated by the lack of clarity in Washington. For health-maintenance-organization plans, the insurer seeks a 22.6% increase if the federal cost-sharing payments end, or 13.8% if they don’t.

A new survey of health insurers by consulting firm Oliver Wyman, a unit of Marsh & McLennan Co s., found that 43% were planning to propose rate increases greater than 20%, while another 36% were looking at boosts of between 10% and 20%. The average rate increase in the May survey, with responses from 14 insurers, was around 20%. Nearly all of the responses assumed that the cost-sharing payments would continue—if they didn’t, insurers said they would either seek further increases or withdraw from the market.

Insurers’ rate proposals, which often need to be approved by regulators before going into effect, are likely to give fodder to both Republicans and Democrats in the argument over the ACA.

Republicans, who have passed a health-care bill through the House and are trying to do so in the Senate, have pointed to insurers’ struggles as signs of problems with the current law. “The laws of economics were in place long before today. These companies were losing hundreds of millions of dollars,” a White House official said.

Democrats argue that the markets would be poised to stabilize, but Republicans are hurting the marketplaces by threatening the cost-sharing payments and raising questions about enforcement of the ACA’s coverage mandate.

“These actions, these statements, these inactions, this uncertainty, has created a huge set of chaos in the individual marketplace leading to instability for insurance carriers, higher premiums, and reduced competition,” said Sen. Tim Kaine (D., Va.) on the Senate floor Thursday.

The insurance industry’s stance on replacing the ACA has been somewhat muted, though it has sought some changes, including the repeal of a tax on insurance plans included in the current health law. Insurers have also said that if the cost-sharing payments aren’t locked in, they expect rate increases and pullbacks from the exchanges.

On Friday a bipartisan group of governors sent a letter to the Senate leadership urging Congress to focus on ways to stabilize the private insurance market.

Some of the biggest rate increases reflect a combination of lingering issues in the marketplaces and federal uncertainty. In Maryland, CareFirst BlueCross BlueShield is proposing a 52% average increase, which it said will need to go even higher if cost-sharing payments aren’t guaranteed. The insurer, which said it has been losing money on the exchanges, said its rates have been falling short of the costs of the relatively unhealthy group of people it enrolled.

Also, CareFirst believes even more healthy people will drop out because they don’t think they will face penalties for lacking coverage. CareFirst said it thinks consumers don’t believe the Trump administration will enforce the mandate, and the House Republican bill would officially end enforcement, if it becomes law.

“The attempt to get back to basic adequacy, together with a worsening risk pool, together with federal actions that lead to uncertainty, that’s what causes it,” said Chet Burrell, CareFirst’s chief executive.

In Delaware, Highmark Health said about a third of the 33.6% rate increase it seeks is due to projected loss of the cost-sharing payments and concerns about the individual coverage mandate, with the rest tied to the need to catch up to higher-than-expected costs that have been generating losses, among other factors. Highmark, set to be the only remaining exchange insurer in Delaware after Aetna Inc.’s withdrawal, said it is still weighing whether it can even offer marketplace plans in the state. “We have to let the next several months play out,” said Alexis Miller, a Highmark senior vice president.

Other insurers said they were seeing signs that markets were steadying and rate increases could be limited—if the federal cost-sharing payments were locked in. In New York, nonprofit Fidelis Care seeks an increase of 8.48%. Blue Cross and Blue Shield of Vermont wants 12.7% in that state. And Blue Cross and Blue Shield of North Carolina said its requested 22.9% boost would have been 8.8% if it could rely on the federal funds.

“There is no evidence to suggest [cost-sharing payments] will be available,” said Brad Wilson, chief executive of the North Carolina insurer.

Insurers are also worried that if they put more rate increases into place, it will lead even more healthy people to drop their coverage, pushing rates up further in the future as there are fewer premiums to offset the higher costs of covering sicker policyholders. Many consumers’ premiums are largely funded by federal subsidies under the ACA, but some people bear the full brunt of premium rises—and may not stick around as the rates go up.

Kevin Lewis, chief executive of Maine Community Health Options, said its 19.6% requested increase is linked closely to expected lack of coverage mandate enforcement.

“It’s the classic case of people who are healthier jumping out of the market,” he said. “It’s a bit of a self-fulfilling prophecy.”

—Stephanie Armour contributed to this article.

Write to Anna Wilde Mathews at anna.mathews@wsj.com and Louise Radnofsky at louise.radnofsky@wsj.com

Appeared in the June 17, 2017, print edition as 'Health Insurers Seek Big Premium Increases.'